Alrighty, folks! So by now you either have your baby emergency fund of a thousand dollars set aside (or you are working towards it) and you have created a budget! Now let’s move on to Ramsey’s second baby step and our third step to preparing financially for marriage: the debt snowball!

Alrighty, folks! So by now you either have your baby emergency fund of a thousand dollars set aside (or you are working towards it) and you have created a budget! Now let’s move on to Ramsey’s second baby step and our third step to preparing financially for marriage: the debt snowball!

How many of you are from a snowy climate? We don’t get too much snow here in central Virginia; however, when we do, it is a big deal! I’ve never seen a snowball roll down a hill and pick up more snow, but I would imagine it would sure be fun to watch, assuming you weren’t at the bottom of the hill about to be tackled by it! So, think about what it must look like to see a small snowball turn into a giant snowball – big enough to take out a small town. That’s the mental picture you should have when thinking about Baby Step Two.

Snowballing!

Let’s talk about how the snowball works. Say you have the following five debts: $5000 left on your car, $700 on a small student loan, $100 on a store card, $300 on another store card, and $2000 on another student loan. Dave’s snowball concept would suggest that you begin by paying off the lowest balance first (your $100 store card), even if the interest rate on your other debt is higher. Why? Because if you get those pesky small debts out of the way, the money you were spending on those debts can roll over to help you pay off your next debt faster. It’s the quick wins in life which make us feel victorious and help to motivate us to continue. It’s just like when you’re starting to lose weight. If you didn’t see any weight reduce for a while, chances are, you’d probably stop doing it.

You then keep snowballing on your next lowest balance ($300 other store card) until that is paid off. Once your two lowest debts are paid off, you’ll have even more money to chuck at the next debt and the snowball gets bigger and bigger. This continues to provide a great deal of motivation and puts your debt payment in motion! Now you have a clear plan and a clear goal. And whenever you pay off another debt, you can celebrate! Each debt that gets paid off is a little more pressure being lifted from your shoulders!

Saving After Punching Out Debt

As mentioned in the first post of this series, Ramsey doesn’t recommend that couples wait until they’re completely debt free to get married (if that’s the only reason – and assuming both people want to be debt free and are willing to aggressively pay off their debt); however, it certainly won’t hurt your future marriage if you walk down the aisle debt free! So if you are engaged, dating, or single, it is a good idea to start punching out your debts. Once they’re gone, the money you bring in can go towards living expenses and savings! Won’t it be nice to keep the income you earn for a change?!?

Once your debt snowball wipes out all of your consumer debt (all debt other than a first mortgage), save, save, save! I’m not suggesting that you never have fun, but treat saving like a big deal because it is!!! When we’re young, we think retirement is so far away that what we do with our money now doesn’t matter… but it does!

If you get in the habit of saving early, you are more likely to continue that habit throughout your life. If you are used to spending all of your income past your immediate bills, you will have a much harder time whipping your finances into shape later. Which is easier? Staying a normal weight or gaining a lot of weight and then having to get back to your normal weight?

Fully Funded Emergencies

The next saving after wiping out your debt is Dave’s third Baby Step which is the fully funded emergency fund (3 to 6 months of expenses [not income]). Once you have this money saved, it’s time to contact one of Ramsey’s Investment ELPs (endorsed local providers) to talk about investments for the next baby step which is to invest 15% of your income. Once you have your debts paid off, a fully funded emergency fund, and 15% of your income going into investments, it’s still a good idea to save.

Have some fun, but don’t quit saving money. You can be a wise saver without turning into a greedy miser. You never know what will come up. Perhaps a half-price vacation opportunity comes up. Won’t you be glad you have money saved (not from your emergency fund) to cover it? What if you need a new AC unit in your house? Won’t it be nice not to have to cut into your emergency fund? Not to mention, as you continue to move through your baby steps, it will be nice to have money to put towards your kids’ college funds, to pay off your house, and to give away to worthy causes. Believe me: giving is the most fun you’ll ever have with money!

Closing Thoughts

So wherever you are in your life right now, it’s never too early or late to start getting your finances in order. If you aren’t in a relationship yet, just think how nice it will be to be financially prepared when God does bring that special someone your way!

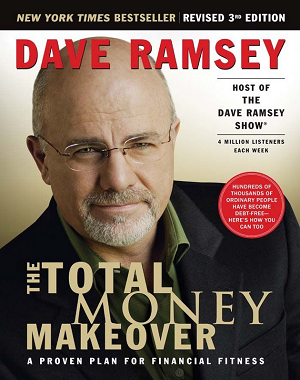

I want to say a special thanks to Dave Ramsey for how much he’s blessed our lives! Eric and I began our marriage by making a few key financial errors, but thankfully we began following the principles Ramsey taught us and because of it we’ve had very few money fights over the years. There is so much peace that comes from being on the same financial page with your spouse! Check out Dave’s bestseller, The Total Money Makeover! You can also visit daveramsey.com for more products and service information from him!

If you’d like a copy, please comment below on your thoughts on knocking out debt and savings and the importance of that to a beginning marriage! If we get five or more relevant comments (by 12-Apr-2013), we will choose a winner at random and send him or her the book! Happy commenting!

How will you feel when your debts are completely paid off and you have three to six months of expenses saved???