Alrighty, folks! So by now you either have your baby emergency fund of a thousand dollars set aside (or you are working towards it) and you have created a budget! Now let’s move on to Ramsey’s second baby step and our third step to preparing financially for marriage: the debt snowball! How many of you are from a snowy climate? We don’t get too much snow here in central Virginia; however, when we do, it is a big deal! I’ve never seen a snowball roll down a hill and pick up more snow, but I would imagine it would sure be fun to watch, assuming you weren’t at the bottom of the hill about to be … [Read more...]

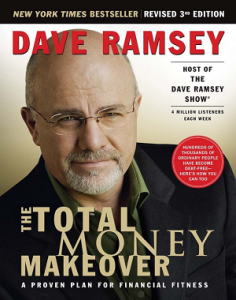

Budgeting for a Healthy Marriage (Book Review, The Total Money Makeover, Part 2)

Whether you’re engaged, dating, trying to get up the courage to ask someone out, or simply chillin’ and waiting for the right man or woman to come along, now is a great time to start living on a budget. If you put twenty random people in a room and asked them how they felt about the idea of budgeting, you’d likely get a myriad of responses. “Budgets are for people who can’t handle money.” “Budgets are for people who don’t make enough money to be comfortable.” “Budgets are essential for a bright financial future!” “Budgets are a necessary evil.” “Budgets are loads of fun!” No matter how you … [Read more...]

Baby Financial Steps Toward a Healthy Marriage (Book Review, The Total Money Makeover, Part 1)

The younger we are when we learn how to handle money, the better it is for us! Though a three-year-old won’t be able to explain terms like ‘diversification,’ they can learn that cleaning their room results in a great big one dollar bill. ~smile~ Teenagers can appreciate the beauty of depositing a paycheck into their savings and checking accounts (and learning to balance a checkbook). Young adults preparing for marriage, and young adults with no intentions of getting married any time soon, can learn how to get on the right financial foot by reading and implementing the information found in a … [Read more...]