Whether you’re engaged, dating, trying to get up the courage to ask someone out, or simply chillin’ and waiting for the right man or woman to come along, now is a great time to start living on a budget. If you put twenty random people in a room and asked them how they felt about the idea of budgeting, you’d likely get a myriad of responses. “Budgets are for people who can’t handle money.” “Budgets are for people who don’t make enough money to be comfortable.” “Budgets are essential for a bright financial future!” “Budgets are a necessary evil.” “Budgets are loads of fun!”

Whether you’re engaged, dating, trying to get up the courage to ask someone out, or simply chillin’ and waiting for the right man or woman to come along, now is a great time to start living on a budget. If you put twenty random people in a room and asked them how they felt about the idea of budgeting, you’d likely get a myriad of responses. “Budgets are for people who can’t handle money.” “Budgets are for people who don’t make enough money to be comfortable.” “Budgets are essential for a bright financial future!” “Budgets are a necessary evil.” “Budgets are loads of fun!”

No matter how you initially feel about budgeting, I am willing to guarantee that your life will be blessed if you create one and live on it faithfully. Sometimes, our budgets don’t work simply because we don’t follow them.

Nerds and Free Spirits

Ramsey often talks about his concept of “nerds and free spirits.” In most marriages, there is one nerd (the one who like the budgets, spreadsheets, etc.) and one free spirit (the one who falls asleep when financial matters come up and would rather fly by the seat of his or her pants). I’m somewhere in the middle. I’m a “free nerd spirit.” ~smile~ When I was a teenager, I enjoyed making budgets (this is my nerd popping out), but after I’d make them, I’d forget about them or decide to do something different with my money (this is my free spirit popping out).

Eric is a nerd backwards and forwards – and he’s quite proud of this fact. ~smile~ So after we got married, he would make the budget and I’d look over it, make comments, or suggest changes if I thought certain categories were too low or too high. It wasn’t extremely easy starting to live on a budget, but once we got into the groove, we have loved having a written cash flow plan for our finances. It has given us (and continues to give us) both a great sense of peace.

Budgeting

In the last post, we talked about saving your baby emergency fund (i.e., $1,000). While you are saving your baby emergency fund, start budgeting (or, how Dave Ramsey would frame it: “create a cash flow plan”). Budgeting can help you complete that first baby step. If you already have your $1,000, then great – put it aside in a safe place and begin your budget. If you don’t have your $1,000, budgeting can also help show you areas you can cut (e.g., reduce eating out from $50 a week to $30, etc.) to help you get your baby emergency fund completed faster!

Another way budgets help us is also why budgeting seems scary at first: it shows us our real financial picture. As long as we avoid budgeting, we can pretend everything is just fine, but when we look at a spreadsheet which has every dime accounted, we have to face the truth. Sometimes the truth looks better than we thought it would – and sometimes it doesn’t; however, regardless of the outcome, there is power in knowledge. Knowing your starting point will help you get going. Do you ever avoid stepping on the scale because you are in denial that you’ve gained weight? Avoiding budgeting is a lot like letting your bathroom scale get covered in dust, but until you take that first step, you can’t get your journey rolling. When it comes to finances, you’ll want to get your muscles in gear as soon as possible! ~smile~

“But what if I start a budget and then find out I can’t live on what I make?” That is an understandable fear, but it’s better to know and work an extra part time job for a while than to pretend everything is great, rack up credit card debt, and then be under much more pressure later as well as having to pay more money later. Budgeting may inspire you to make a career change, to apply for that promotion, or to request that raise you believe you deserve.

Zero-Based Budget

Something important to remember about budgeting is to account for all your money. Don’t set aside $100 and budget the rest. Budget everything that comes through from paychecks to side jobs to birthday money. This doesn’t mean you can’t spend your birthday money the way you want to, but put it in the budget and be clear about how you’re spending it. Dave’s phrase for this is: “every dollar has a name.” This means that you assign a job to each of your dollars and once you’re done with your budget, it should then equal zero.

Did you just grab your chest for air? What Ramsey means by a zero-based budget is that you tell your money what to do (“instead of wondering where it went”). If you have all of your bills paid, no debt, and you have $500 leftover for the month, instead of just spending it and wondering where it went, assign it a job. Maybe part of it could go into savings, another part into clothing, and another part into entertainment.

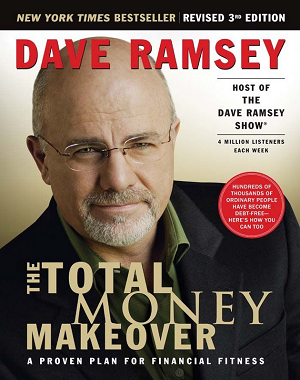

For more information on budgeting and creating a solid financial plan, check out Dave Ramsey’s book, The Total Money Makeover! It’s a terrific and life-changing read!

If you’d like a copy, please comment below on your thoughts on maintaining a budget and the importance of that to a beginning marriage! If we get five or more relevant comments (by 10-Apr-2013), we will choose a winner at random and send him or her the book! Happy commenting!

What is your experience with budgeting?